Eat, drink, and Be Merry, but please don't forget to gamble!

Apr 08, 2025In the glittering oasis of Las Vegas and beyond, a subtle but significant transformation has been taking place over the past several years. The traditional bread and butter of casino resorts—the gambling floor—is increasingly competing for customer dollars with the very amenities originally designed to complement it.

Over and over, I hear how table game directors are competing with and losing the battle of consumer spending inside their own resorts. $95 Baked Potatoes, $25 Luxe Cocktails, $525 tasting menus, $1400 Event Tickets, $800 Suites, $40 Valet fees….all of it taking real dollars from the pockets of real gamblers.

Mirage Economy

When Steve Wynn revolutionized Las Vegas with The Mirage in 1989, he pioneered a new philosophy: create spectacular resorts where gambling was just one part of the experience. This philosophy has evolved dramatically, particularly since 2017, creating both opportunities and challenges for casino operators.

This evolution has created a paradox for casino operators: the very amenities designed to attract visitors to the gaming floor are now competing with it for customer dollars.

The Numbers Tell the Story

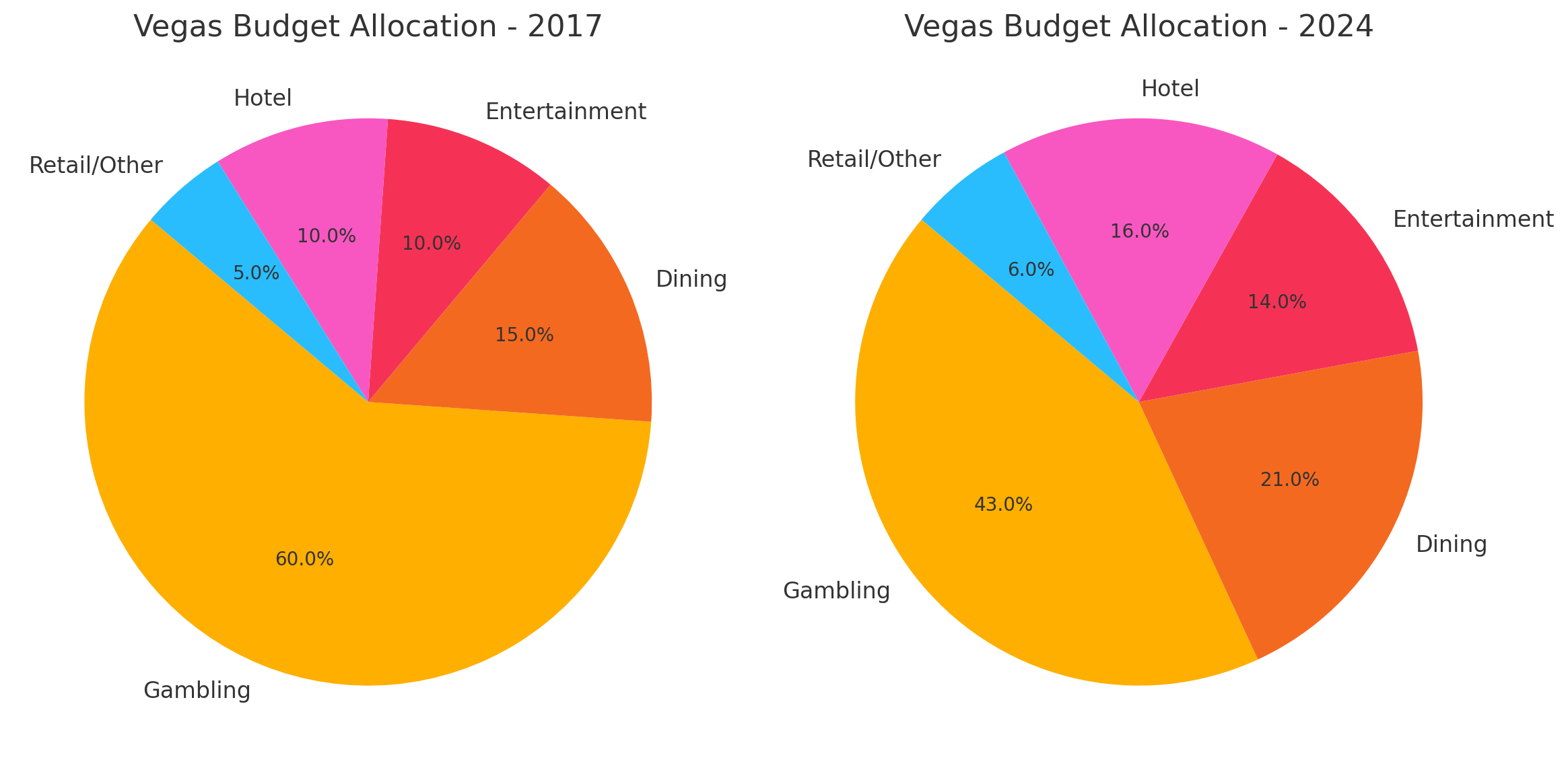

The statistics paint a clear picture of this shift:

- Hotel Accommodations: The average nightly rate at major casino resorts has increased approximately 35% since 2017, from $149 to $201 in 2024, far outpacing inflation.

- Fine Dining: The average check at signature restaurants within casino properties has climbed nearly 42% in the same period, from $87 per person to $124.

- Entertainment: Ticket prices for headline shows have seen a 38% increase, with premium seats now routinely exceeding $250.

- Retail: High-end shopping arcades within casino complexes have expanded by an average of 28% in square footage since 2017.

Meanwhile, the average gambling budget per visitor has remained relatively flat, increasing only about 12% since 2017—barely keeping pace with inflation.

Zero-Sum Game?

Industry experts point to a fundamental economic reality: most visitors have a finite vacation budget. When more of that budget is allocated to $45 breakfast buffets, $400 concert tickets, and $700 hotel suites, less remains for the gaming tables and slot machines.

Industry data suggests that the average visitor to Las Vegas in 2017 would spend approximately 60% of their total budget on gambling. By early 2024, that proportion had dropped to approximately 43%—representing a seismic shift in how visitors allocate their discretionary spending.

Finding Balance

Casino operators find themselves in a delicate balancing act. Non-gaming amenities offer more predictable revenue streams with higher profit margins than the inherently volatile gambling business. A luxury suite can generate a guaranteed $800 per night, while even the most sophisticated algorithms can't predict with certainty how much a high roller will win or lose.

MGM Resorts International reported in their 2023 annual report that non-gaming revenue represented 67% of their Las Vegas Strip properties' total revenue, up from 58% in 2017. Caesars Entertainment showed similar trends, with non-gaming revenue climbing from 52% to 64% over the same period.

The New Casino Customer

The shift reflects changing consumer preferences, particularly among younger demographics.

Millennials and Gen Z visitors typically come for the total experience. These younger demographics are more likely to share social media photos of a spectacular meal or a luxury suite while being barred from doing the same at a gaming table. This group clearly values curated experiences they can share on social media over the chance to win big without sharing.

This demographic reality has pushed casino operators to continuously elevate their non-gaming offerings, creating ever more lavish—and expensive—amenities in a competitive arms race.

Some innovation ahead;

- Dynamic Pricing and Incentives: “Some” casinos are becoming more sophisticated in offering gambling incentives to guests who spend heavily on other amenities.

- Integrated Gambling Experiences: New offerings that blend entertainment with gambling, such as stadium-style electronic table games with entertainment components.

- App Integration: Mobile apps that allow guests to move seamlessly between gambling and other activities, maintaining engagement with the casino brand.

- Loyalty Program Evolution: Rewards programs that recognize total resort spending rather than focusing primarily on gambling metrics.

Strategic Innovations

Beyond these industry-wide trends, several specific strategies could help casinos reinvigorate their relationship with gamblers:

- Value-Based Engagement for Regular Gamblers: Casinos need to shift focus back to promoting value and incentivizing relationships with regular gamblers. This means creating clear schedules of discounted tables, match plays, tournaments, and special opportunities that specifically reward loyal gamblers. The goal should be to give dedicated players tangible reasons to return to the gaming floor rather than spending their budget elsewhere.

- Structured Social Media Integration: Properties should designate and promote specific moments for approved social media interaction on the gaming floor. By clearly advertising the means, times, and ways that guests can record or share their experience on social media, casinos can harness the marketing power of user-generated content while maintaining necessary gaming regulations and privacy considerations.

- Enhanced Digital Accessibility: Implementing QR codes throughout the property for instant table game lookups, restaurant information, and venue details would streamline the guest experience. These could connect to AI-powered chatbots or "help" features that allow for immediate assistance. This digital layer enhances the traditional casino experience without detracting from it.

- Dedicated Social Media Ambassadors: Rather than placing untrained security or floor staff in the uncomfortable position of policing social media usage, casinos should invest in properly trained social media hosts or ambassadors. These dedicated personnel would be specifically tasked with promoting appropriate social media opportunities throughout the property, assisting guests with creating shareable content, and proactively engaging with visitors using social platforms. This approach transforms what is often an adversarial interaction into a positive, brand-building opportunity while ensuring compliance with gaming regulations.

A Delicate Balance

The modern casino resort walks a tightrope between cultivating luxury non-gaming experiences and maintaining the gambling revenue that has historically been the industry's foundation.

The reality for today's casino operators is that they're no longer solely in the gambling business—they're in the integrated resort business, where every element must work in harmony.

The Next Gen is Today

The time to innovate isn’t coming—it’s already here. Operators who embrace integrated technology, elevate every guest interaction, and give gamblers real reasons to return to the tables will lead the next generation of gaming resorts.

Because while the house may always win, the new wins are just as likely to come from the hotel room, the tasting menu, and the rooftop spa as they are from the blackjack table.